Div 293 - Concessional contributions

- Lachlan Murnaghan

- Nov 22, 2021

- 1 min read

Updated: Feb 16, 2022

Rather commonly we get asked by clients, what is the tax treatment of super contributions, and what is the tax on concessional contributions (Division 293)

You can generally contribute up to $27,500 each financial year. These contributions are taxed at 15%.

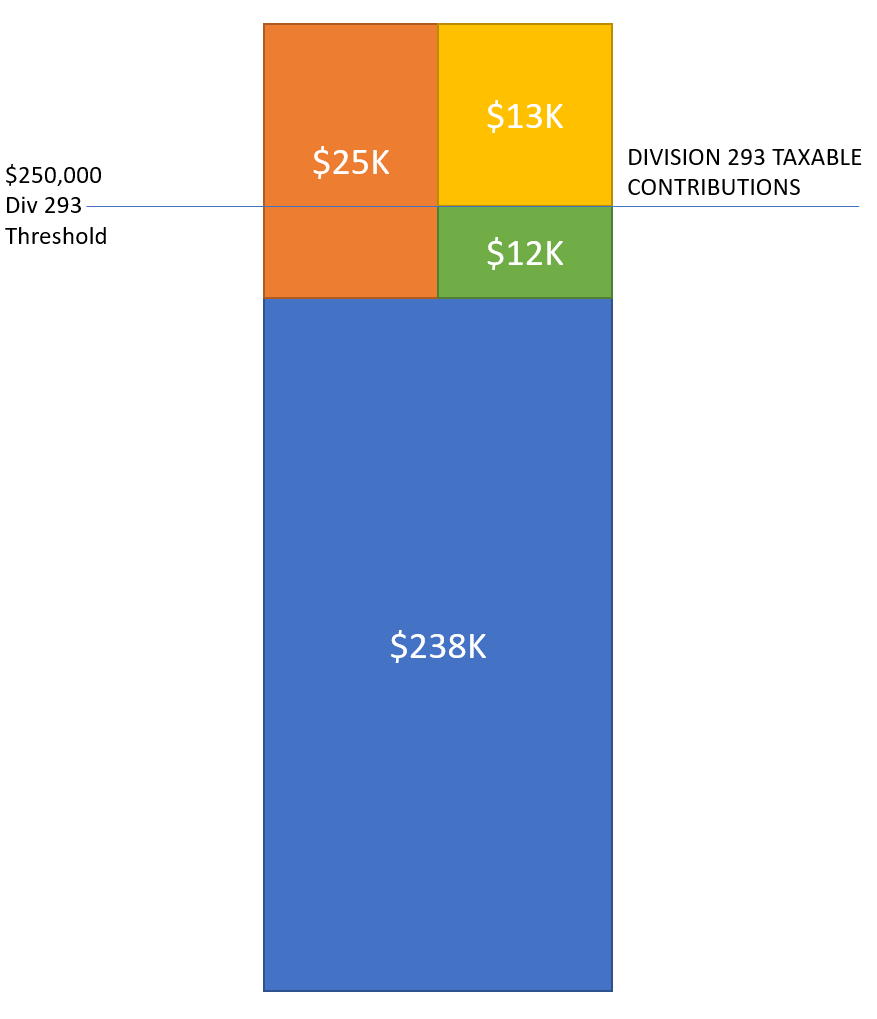

If you earn over $250,000, you may pay an extra 15% tax—so in total, you’ll pay 30% tax on some or all of the contributions

In the below example, as the Taxpayer has exceeded the $250,000 threshold by $13,000, the taxpayer will be liable for the 15% contributions tax.

Division 293 tax = $13,000 x 15% tax = $1,950

How to pay

By paying Division 293 tax to us by the due date you will avoid paying interest.

You can pay Division 293 tax liabilities either:

with your own money – see how to pay

by releasing money from super – see making an election to release money from super

Comments